市场噪声

市场噪声概念

它是指在金融市场上由不确定性、偶然因素或非有用信息引起的价格和交易量的随机波动。这些无意义的波动可能会让投资者对市场走势的真实情况产生误解,从而影响投资决策。

举个通俗的例子:市场噪声很像一个喝酒的人走路回家。设想一个醉汉从酒吧出来,家在酒吧不远处的正北方。由于喝醉了,他走路左摇右晃,甚至可能朝南走,每次步伐方向随机(左、右、前、后),但最终会到家,因为他知道需要向北走。

- 醉汉的步伐:代表市场噪声(短期随机波动)。

- 最终回家的方向:代表市场潜在趋势(长期方向)。

尽管市场短期可能上下波动(如醉汉左摇右晃),但长期会呈现明显趋势(如醉汉最终回家)。投资者需从噪声中筛选有用信息,看清市场真正趋势。

当噪声微小,市场趋势容易识别;噪声增加时,有意义的价格行为模糊,甚至变成随机运动,此时很多交易系统会失效。

噪声的成因与影响

为什么存在噪声?量化交易大师佩里·考夫曼(Perry Kaufman)指出,噪声是市场无处不在的现象,无法消除,交易者必须学会应对。

- 价格行为分类:

- 有意义的价格行为:长期、有方向、有目的的运动(如从A点到B点)。

- 随机价格行为:短暂、无方向、无目的的波动(由大量交易者的短期操作引发)。

市场参与者在多个时间周期执行不同策略,短期操作的随机性导致噪声,而市场主导情绪推动长期趋势。

以趋势跟踪策略为例,噪声会导致策略失效:

- 噪声低时,策略能捕捉趋势并盈利;

- 噪声高时,价格频繁来回波动,吞噬利润,甚至导致亏损(如频繁假突破、来回止损)。

噪声的量化与应用

衡量噪声的方法之一是效率比(由考夫曼开发),用于量化市场噪声高低:

- 效率比高位:噪声低,适合趋势策略;

- 效率比低位:噪声高,适合震荡或区间策略。

通过计算价格密度(价格在区间内的填充程度),可判断噪声水平:

- 价格平稳地从区间一角到另一角:低噪声;

- 价格频繁填充整个区间:高噪声。

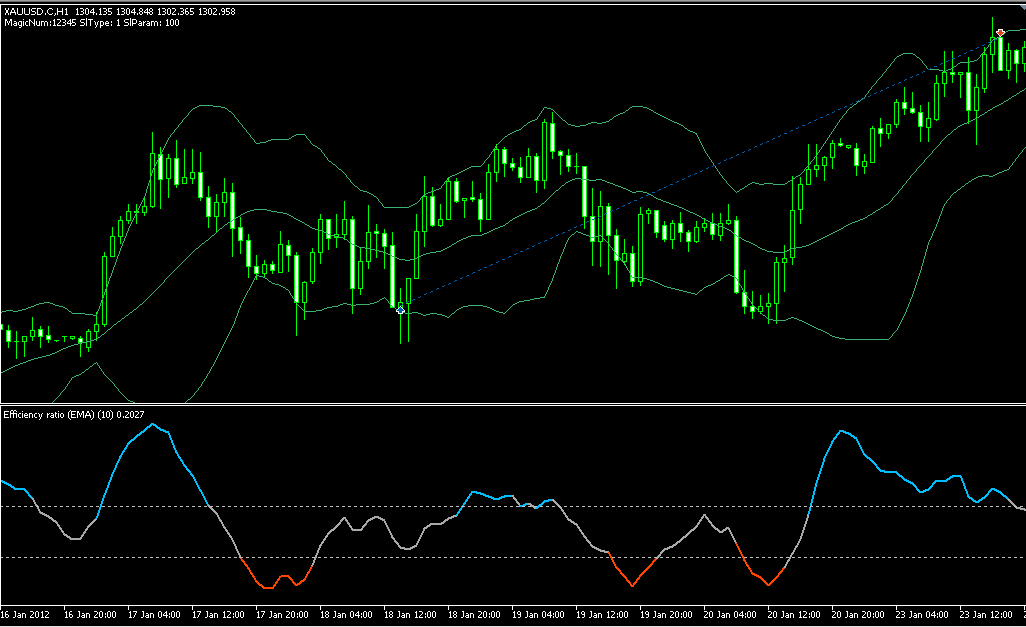

策略细节(以多单为例,空单条件反向)

进场条件

- 无多单持仓;

- 收盘价跌破布林带下沿;

- 噪声过滤器触发:效率比<0.3(高噪声环境)。

出场条件

- 有多单持仓;

- 收盘价涨破布林带上沿,于下一根K线开盘价平仓。

止损设置

基于布林带上下轨距离的百分比:

- 例:上下轨距离30点,止损比例50%,则止损15点(从开仓价向下计算)。

资金管理

固定手数或按风险比例计算,代码中包含持仓判断、价格规范等函数。

开仓图示

代码实现要点

主程序代码

cpp

#property strict

#include <Util/Util.mqh>

Util util;

// 不可以做参数优化的参数

input group "固定和输入通用部分"

sinput int MagicNum = 12345; // EA唯一编号

sinput int SlType = 1; // 止损方式(1:固定金额{100}美金 2:账户{1}% 3:固定{0.1}手 4:子账户总账户{1}%)

sinput int SlParam = 100; // 止损依据(根据上方【止损方式】的不同,所代表的含义也不同)

input group "参数优化"

input ENUM_TIMEFRAMES TimeFrame = PERIOD_H1; // 时间周期

input int BbPeriod = 20; // BB 周期

input int SlBBandsRange = 70; //SLBBandsRange(%)

input int efficiencyRatio = 10; // 效率比率(%)

int barsTotal;

int handle;

double upperBuffer[];

double baseBuffer[];

double lowerBuffer[];

int initBalance;

double point;

MqlTick currentTick;

int efficiencyRatioHandle;

double efficiencyRatioBuffer[];

int OnInit()

{

if (MagicNum < 0)

{

Alert("MagicNum<0");

return INIT_PARAMETERS_INCORRECT;

}

if (BbPeriod < 1)

{

Alert("RSIPeriod<1");

return INIT_PARAMETERS_INCORRECT;

}

handle = iBands(_Symbol,TimeFrame,BbPeriod,0,2,PRICE_CLOSE);

efficiencyRatioHandle = iCustom(_Symbol, TimeFrame,"Efficiency Ratio",efficiencyRatio,PRICE_CLOSE, 0.2);

if (handle == INVALID_HANDLE)

{

Alert((string)MagicNum + " ", _Symbol, " handle 创建失败");

return INIT_FAILED;

}

ArraySetAsSeries(upperBuffer, true);

ArraySetAsSeries(baseBuffer, true);

ArraySetAsSeries(lowerBuffer, true);

ArraySetAsSeries(efficiencyRatioBuffer, true);

Print(MagicNum, " ", _Symbol, "实例化成功");

// 当用户没有打开参数对应的图表周期,自动帮他打开对应周期

if (MQLInfoInteger(MQL_TESTER))

{

ChartSetInteger(0,CHART_SHOW_GRID,false);

}else{

ChartSetSymbolPeriod(0,_Symbol, TimeFrame);

}

initBalance = SlParam;

Comment("MagicNum:", MagicNum, " SlType: ", SlType, " SlParam: ", SlParam);

return INIT_SUCCEEDED;

}

// 节省内存后 买VPS就可以买小一点

void OnDeinit(const int reason)

{

if (handle != INVALID_HANDLE)

{

IndicatorRelease(handle);

}

}

void OnTick()

{

if (!util.isNewBar(_Symbol, TimeFrame, barsTotal))

return;

if(!util.isEnableTimezone()) return; // 点差过大0 不交易

datetime a = StringToTime("2012.01.6 5:00:00");

if(iTime(_Symbol,PERIOD_CURRENT,0) == StringToTime("2012.01.6 5:00:00")){

Print("debug");

}

point = SymbolInfoDouble(_Symbol, SYMBOL_POINT);

int digits = (int) SymbolInfoInteger(_Symbol, SYMBOL_DIGITS);

if (!SymbolInfoTick(_Symbol, currentTick))

{

Print("tick数据获取异常");

}

CopyBuffer(handle, 1, 0, 2, upperBuffer);

CopyBuffer(handle, 2, 0, 2, lowerBuffer);

CopyBuffer(efficiencyRatioHandle, 0, 0, 2, efficiencyRatioBuffer);

int cntBuy, cntSell;

if (!util.countOpenPositions(MagicNum, cntBuy, cntSell))

return;

double ask = SymbolInfoDouble(_Symbol, SYMBOL_ASK);

double bid = SymbolInfoDouble(_Symbol, SYMBOL_BID);

double bullSignal = cntBuy==0 && iClose(_Symbol,TimeFrame,1) <= lowerBuffer[1] && MathAbs(efficiencyRatioBuffer[1])<0.2;

if (bullSignal)

{

double bbRange = upperBuffer[1] - lowerBuffer[1];

double slPoint = NormalizeDouble(bbRange*0.01 * SlBBandsRange,digits);

double sl = currentTick.ask -slPoint;

double tp = 0;

if (!util.NormalizePrice(_Symbol, sl))

return;

if (!util.NormalizePrice(_Symbol, tp))

return;

double slp = SlParam;

if (SlType == 4)

{

slp = util.calculateEachEaBalance(MagicNum, initBalance); // 子账户百分之一

}

double lotSize = util.calcLots(_Symbol, ask, sl, SlType, slp);

trade.SetExpertMagicNumber(MagicNum);

trade.PositionOpen(_Symbol, ORDER_TYPE_BUY, lotSize, currentTick.ask, sl, tp, "BBR BUY");

}

bool bearSignal = cntSell ==0 && iClose(_Symbol,TimeFrame,1) >= upperBuffer[1] && MathAbs(efficiencyRatioBuffer[1])<0.2;

if (bearSignal)

{

double bbRange = upperBuffer[1] - lowerBuffer[1];

double slPoint = NormalizeDouble(bbRange*0.01 * SlBBandsRange,digits);

double sl = currentTick.bid + slPoint;

double tp = 0;

if (!util.NormalizePrice(_Symbol, sl))

return;

if (!util.NormalizePrice(_Symbol, tp))

return;

double slp = SlParam;

if (SlType == 4)

{

slp = util.calculateEachEaBalance(MagicNum, initBalance); // 子账户百分之一

}

double lotSize = util.calcLots(_Symbol, bid, sl, SlType, slp);

trade.SetExpertMagicNumber(MagicNum);

trade.PositionOpen(_Symbol, ORDER_TYPE_SELL, lotSize, currentTick.bid, sl, tp, "BBR SELL");

}

// 出场

if(!util.countOpenPositions(MagicNum, cntBuy, cntSell)) return;

if(cntBuy >0 && iClose(_Symbol,TimeFrame,1)>= upperBuffer[1] ){

util.closePositions(MagicNum, POSITION_TYPE_BUY);

}

if(cntSell >0 && iClose(_Symbol,TimeFrame,1)<= lowerBuffer[1] ){

util.closePositions(MagicNum, POSITION_TYPE_SELL);

}

}副图效率指标源码

cpp

//+------------------------------------------------------------------

#property copyright "mladen"

#property link "mladenfx@gmail.com"

#property link "https://www.mql5.com"

#property description "Directional efficiency ratio"

//+------------------------------------------------------------------

#property indicator_separate_window

#property indicator_buffers 4

#property indicator_plots 1

#property indicator_label1 "Efficiency ratio"

#property indicator_type1 DRAW_COLOR_LINE

#property indicator_color1 clrDarkGray,clrDeepSkyBlue,clrOrangeRed

#property indicator_width1 2

//--- input parameters

enum enMaTypes

{

ma_sma, // Simple moving average

ma_ema, // Exponential moving average

ma_smma, // Smoothed MA

ma_lwma // Linear weighted MA

};

input int inpPeriod = 14; // ER period

input ENUM_APPLIED_PRICE inpPrice = PRICE_CLOSE; // Price

input double inpLevels = 0.25; // Levels for trending/ranging

input int inpSmoothingPeriod = 5; // Smoothing period

input enMaTypes inpMaMethod = ma_ema; // Smoothing method

//--- buffers and global variables declarations

double val[],valc[],diff[],prices[];

string _avgNames[]={"SMA","EMA","SMMA","LWMA"};

//+------------------------------------------------------------------+

//| Custom indicator initialization function |

//+------------------------------------------------------------------+

int OnInit()

{

//--- indicator buffers mapping

SetIndexBuffer(0,val,INDICATOR_DATA);

SetIndexBuffer(1,valc,INDICATOR_COLOR_INDEX);

SetIndexBuffer(2,diff,INDICATOR_CALCULATIONS);

SetIndexBuffer(3,prices,INDICATOR_CALCULATIONS);

IndicatorSetInteger(INDICATOR_LEVELS,2);

IndicatorSetDouble(INDICATOR_LEVELVALUE,0,inpLevels);

IndicatorSetDouble(INDICATOR_LEVELVALUE,1,-inpLevels);

//---

IndicatorSetString(INDICATOR_SHORTNAME,"Efficiency ratio ("+_avgNames[inpMaMethod]+") ("+(string)inpPeriod+")");

return (INIT_SUCCEEDED);

}

//+------------------------------------------------------------------+

//| Custom indicator de-initialization function |

//+------------------------------------------------------------------+

void OnDeinit(const int reason)

{

}

//+------------------------------------------------------------------+

//| Custom indicator iteration function |

//+------------------------------------------------------------------+

int OnCalculate(const int rates_total,

const int prev_calculated,

const datetime &time[],

const double &open[],

const double &high[],

const double &low[],

const double &close[],

const long &tick_volume[],

const long &volume[],

const int &spread[])

{

if(Bars(_Symbol,_Period)<rates_total) return(prev_calculated);

int i=(int)MathMax(prev_calculated-1,1); for(; i<rates_total && !_StopFlag; i++)

{

prices[i] = getPrice(inpPrice,open,close,high,low,i,rates_total);

diff[i] = (i>0) ? prices[i]-prices[i-1] : 0;

//-------------

double _noise = MathAbs(diff[i]); int k=1; for(; k<inpPeriod && (i-k)>=0; k++) _noise+=MathAbs(diff[i-k]);

double _efr = (_noise!=0 && i>inpPeriod) ? (prices[i]-prices[i-inpPeriod+1])/_noise : 0;

val[i] = iCustomMa(inpMaMethod,_efr,inpSmoothingPeriod,i,rates_total,0);

valc[i]= (val[i]>inpLevels) ? 1 :(val[i]<-inpLevels) ? 2 : 0;

}

return (i);

}

//+------------------------------------------------------------------+

//| Custom functions |

//+------------------------------------------------------------------+

#define _maInstances 1

#define _maWorkBufferx1 1*_maInstances

//+------------------------------------------------------------------+

//| |

//+------------------------------------------------------------------+

double iCustomMa(int mode,double price,double length,int r,int bars,int instanceNo=0)

{

switch(mode)

{

case ma_sma : return(iSma(price,(int)length,r,bars,instanceNo));

case ma_ema : return(iEma(price,length,r,bars,instanceNo));

case ma_smma : return(iSmma(price,(int)length,r,bars,instanceNo));

case ma_lwma : return(iLwma(price,(int)length,r,bars,instanceNo));

default : return(price);

}

}

//

//

//

//

//

double workSma[][_maWorkBufferx1];

//+------------------------------------------------------------------+

//| |

//+------------------------------------------------------------------+

double iSma(double price,int period,int r,int _bars,int instanceNo=0)

{

if(ArrayRange(workSma,0)!=_bars) ArrayResize(workSma,_bars);

workSma[r][instanceNo]=price;

double avg=price; int k=1; for(; k<period && (r-k)>=0; k++) avg+=workSma[r-k][instanceNo];

return(avg/(double)k);

}

//+------------------------------------------------------------------+

//| |

//+------------------------------------------------------------------+

double workEma[][_maWorkBufferx1];

//+------------------------------------------------------------------+

//| |

//+------------------------------------------------------------------+

double iEma(double price,double period,int r,int _bars,int instanceNo=0)

{

if(ArrayRange(workEma,0)!=_bars) ArrayResize(workEma,_bars);

workEma[r][instanceNo]=price;

if(r>0 && period>1)

workEma[r][instanceNo]=workEma[r-1][instanceNo]+(2.0/(1.0+period))*(price-workEma[r-1][instanceNo]);

return(workEma[r][instanceNo]);

}

//+------------------------------------------------------------------+

//| |

//+------------------------------------------------------------------+

double workSmma[][_maWorkBufferx1];

//+------------------------------------------------------------------+

//| |

//+------------------------------------------------------------------+

double iSmma(double price,double period,int r,int _bars,int instanceNo=0)

{

if(ArrayRange(workSmma,0)!=_bars) ArrayResize(workSmma,_bars);

workSmma[r][instanceNo]=price;

if(r>1 && period>1)

workSmma[r][instanceNo]=workSmma[r-1][instanceNo]+(price-workSmma[r-1][instanceNo])/period;

return(workSmma[r][instanceNo]);

}

//+------------------------------------------------------------------+

//| |

//+------------------------------------------------------------------+

double workLwma[][_maWorkBufferx1];

//+------------------------------------------------------------------+

//| |

//+------------------------------------------------------------------+

double iLwma(double price,double period,int r,int _bars,int instanceNo=0)

{

if(ArrayRange(workLwma,0)!=_bars) ArrayResize(workLwma,_bars);

workLwma[r][instanceNo] = price; if(period<1) return(price);

double sumw = period;

double sum = period*price;

for(int k=1; k<period && (r-k)>=0; k++)

{

double weight=period-k;

sumw += weight;

sum += weight*workLwma[r-k][instanceNo];

}

return(sum/sumw);

}

//+------------------------------------------------------------------+

//| |

//+------------------------------------------------------------------+

double getPrice(ENUM_APPLIED_PRICE tprice,const double &open[],const double &close[],const double &high[],const double &low[],int i,int _bars)

{

switch(tprice)

{

case PRICE_CLOSE: return(close[i]);

case PRICE_OPEN: return(open[i]);

case PRICE_HIGH: return(high[i]);

case PRICE_LOW: return(low[i]);

case PRICE_MEDIAN: return((high[i]+low[i])/2.0);

case PRICE_TYPICAL: return((high[i]+low[i]+close[i])/3.0);

case PRICE_WEIGHTED: return((high[i]+low[i]+close[i]+close[i])/4.0);

}

return(0);

}

//+------------------------------------------------------------------+